The Ultimate Deception

“Making something out of nothing” has often been the American Way to create wealth. We take a simple idea and turn it into a business, providing jobs, tax revenue and overall security. In this instance, creating something out of nothing is in line with the true act of Creation—organizing matter. But it’s important to know that there’s a constant enemy that attempts to portray makes something out of nothing. This particular act isn’t Creation though. It is nothing more than a scam; an expensive parlor trick, that is intent on destruction and control; not enriching our surroundings like the true art of Creation. As one who is intent on independence and preparedness, it’s important that you are aware of this particular deception for it is truly the ultimate deception.

“Making something out of nothing” has often been the American Way to create wealth. We take a simple idea and turn it into a business, providing jobs, tax revenue and overall security. In this instance, creating something out of nothing is in line with the true act of Creation—organizing matter. But it’s important to know that there’s a constant enemy that attempts to portray makes something out of nothing. This particular act isn’t Creation though. It is nothing more than a scam; an expensive parlor trick, that is intent on destruction and control; not enriching our surroundings like the true art of Creation. As one who is intent on independence and preparedness, it’s important that you are aware of this particular deception for it is truly the ultimate deception.

Understand that this article, as well as the last two, are written as the result of over 2,000 hours of study and research on this matter. I have read volumes and volumes of materials. And here I am trying to summarize it in 3 articles. As a result, I must apologize for my inevitable lack of words which would do this topic justice and encourage you to make it a matter of study for yourself. On thing I will tell you bluntly, money is SUPPOSED to be a complicated issue. If it’s complicated then the scam is less likely to be unveiled. So, buck the trend, I say. 😉

Money is not Wealth

As I shared in a previous article, money is not wealth. It is merely a symbol of the trade of goods and services which actually ARE wealth. Money is lifeless and barren. It has no ability to reproduce, duplicate, or compound. Such results are accomplished simply by persons who are willing to say that  money has “increased.” I realize that such a statement may be hard to swallow. After all, we’ve been accepting of the theory of compounding and interest-bearing for decades. But the concept of interest being earned on money is simply a manmade façade. Aristotle says it best:

money has “increased.” I realize that such a statement may be hard to swallow. After all, we’ve been accepting of the theory of compounding and interest-bearing for decades. But the concept of interest being earned on money is simply a manmade façade. Aristotle says it best:

“Money is naturally barren, to make it breed money is preposterous, and a perversion from the end of its institution, which was only to serve the purpose of exchange and not of increase…Usury is most reasonably detested as the increases arises from the money itself and not be employing it to the purpose for which it was intended.”

Fraudulent Wealth

Allowing money to represent wealth and to use such a false representation to create even more money is as fraudulent as a shoplifter having stolen a good only to return it to the store to get their money back. Procuring goods or services without work or production of any kind is that actions of a thief. The shysters of our world are attempting to have us believe that they are increasing in wealth without having PRODUCED a single thing…not an action, not a product, not even a thought. This makes compounding and interest-bearing nothing more than robbery.

So why is interest such a popularly applied method in our international world of finance? Because interest is about a gradual transfer of power and wealth from a society to an entity.

Here’s an example. I know that many of you would never think of using this particular service, but allow me to use it to better illustrate my point. Suppose you needed a couple thousand dollars for a medical procedure  which would save your child’s life. So you’re willing to take an advance on your next month’s worth of wages in order to borrow that money ahead of time from one of those “cash your checks here” places. As a result, you are assessed a fee of 35% of the $2,000. To recap, you are borrowing $2,000 and you will be paying back $2,700. So, let’s zero in on what this “cash your checks here” place did to earn that $700. Did they contribute anything to the economy? Did they produce anything? Did they provide a particular expertise to society? No. They simply capitalized on your emotions and your fear. They have nothing but a barren building and neon signs. And for that they increased their barren money 35%. Wait, it is even more crazy than what I’m illustrating here.

which would save your child’s life. So you’re willing to take an advance on your next month’s worth of wages in order to borrow that money ahead of time from one of those “cash your checks here” places. As a result, you are assessed a fee of 35% of the $2,000. To recap, you are borrowing $2,000 and you will be paying back $2,700. So, let’s zero in on what this “cash your checks here” place did to earn that $700. Did they contribute anything to the economy? Did they produce anything? Did they provide a particular expertise to society? No. They simply capitalized on your emotions and your fear. They have nothing but a barren building and neon signs. And for that they increased their barren money 35%. Wait, it is even more crazy than what I’m illustrating here.

Wealth Does Not Equal Money

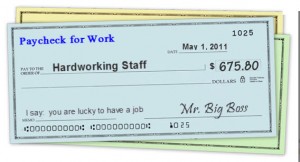

When a bank takes in the result of your work, production, expertise, etc. in the form of your paycheck, they simply add more digits to the screen that you see when you log into your bank account. Maybe that sounds simplistic, but tell me I’m wrong. Where’s the actual MONEY? All they did was remove digits from your employer. They didn’t handle currency at any time  whatsoever. Then, based on the accumulation of those “digits” that you see on the screen, that you and every other of their customers contribute, they are given a special lending authority from the Federal Reserve. The Federal Reserve says that for every $1.00 that they show on their books taken in as a deposit (ie: in the form of a paycheck) they are allowed to lend out 92% to the public and charge interest on it. So now let’s say that Mr. and Mrs. Jones decide that they would like to go on a cruise. Thus they ask to borrow $5,000 from the bank. The bank says “Sure. According to our books, we’ve got $5,000 to lend you. And we’ll be happy to do so at an interest rate of 10%.” The loan is simply a digital bookkeeping entry folks. To be clear. The bank is lending the Jones’s $5,000 as the result of other deposits on their books of only 8% more than this $5,000. Eight percent! What a cushion to prevent a run on the bank, eh? No wonder there have been a record number of bank bailouts AND the FDIC is now on the verge of bankruptcy.

whatsoever. Then, based on the accumulation of those “digits” that you see on the screen, that you and every other of their customers contribute, they are given a special lending authority from the Federal Reserve. The Federal Reserve says that for every $1.00 that they show on their books taken in as a deposit (ie: in the form of a paycheck) they are allowed to lend out 92% to the public and charge interest on it. So now let’s say that Mr. and Mrs. Jones decide that they would like to go on a cruise. Thus they ask to borrow $5,000 from the bank. The bank says “Sure. According to our books, we’ve got $5,000 to lend you. And we’ll be happy to do so at an interest rate of 10%.” The loan is simply a digital bookkeeping entry folks. To be clear. The bank is lending the Jones’s $5,000 as the result of other deposits on their books of only 8% more than this $5,000. Eight percent! What a cushion to prevent a run on the bank, eh? No wonder there have been a record number of bank bailouts AND the FDIC is now on the verge of bankruptcy.

Wealth is not Cash

Wealth is not Cash

Let’s remember that YOU didn’t deposit any cash into their bank account. You deposited a piece of paper that is a representation of the work that you’ve contributed to your employer. And it’s not likely that very many other people have deposited actual cash into a bank account. Usually they end up depositing digits on a piece of paper. So, how is the bank “earning” $500 on their $5,000? What did they produce or contribute or provide to society? AIR! The money by which they are basing their 92% lending ratio is a façade. And they are charging $500 for the privilege of the Jones’s passing a long that façade to someone else. This process is repeated again and again and again. Your retirement funds are based on this façade. And the money that the “cash your check here” place had to lend you is based on the acceptance of this façade. I like how the author, Ken Bowers, calls this kind of play so succinctly. He says “if anyone else tried to do that, it would (be) called counterfeiting.” But every single bank in the world does it, courtesy of the authority granted to them by the Federal Reserve Bank and its cronies.

When you pay back the $700 to the “cash your check here” place, how did you get it? By actually working, right? When the Jones’s pay back their loan to the bank, how did they get the money to pay it back? By actually producing something, right? How absolutely crazy is it that we are basing our weekly survival, our future, our retirements based on this hollow corpse of a sham? We produce real goods and services and then exchange them for fake ones? What a DEAL, eh?

What few people realize is that the Revolutionary War was actually fought in part over the worthless nature of the Continental Dollar. The government insisted on paying the troops with them, yet the same government would not accept them as payment of people’s taxes. The Continental Dollar decreased to a value of only two cents per dollar! Our U.S. dollar is actually only worth 2-3 cents based on what buying power a dollar had in 1913 before the Federal Reserve was created.

The largest problem is, is that there is NOTHING tangible to back up our currency. There is no gold in Fort Knox. It was already leveraged. There isn’t even wheat in our storehouses. Our rich farmlands which were the epitome of the production and wealth of our nation have been marginalized at every turn. The land grabs that you see throughout our nation on behalf of the U.S. Government are simply to collateralize our debt to international banking powers (in the name of foreign nations.) Land is actually worth something because it’s tangible. And thus the more land the U.S. Government claims to be their own, the more they can collateralize the bogus currency they borrow from other nations. So you see, they are required to have something tangible to back up their loans taken from other nations, but they are not required to have anything tangible to back up the money we rely on in our daily lives.

The largest problem is, is that there is NOTHING tangible to back up our currency. There is no gold in Fort Knox. It was already leveraged. There isn’t even wheat in our storehouses. Our rich farmlands which were the epitome of the production and wealth of our nation have been marginalized at every turn. The land grabs that you see throughout our nation on behalf of the U.S. Government are simply to collateralize our debt to international banking powers (in the name of foreign nations.) Land is actually worth something because it’s tangible. And thus the more land the U.S. Government claims to be their own, the more they can collateralize the bogus currency they borrow from other nations. So you see, they are required to have something tangible to back up their loans taken from other nations, but they are not required to have anything tangible to back up the money we rely on in our daily lives.

So why do I say that such a façade represents the shifting of power from a society to a couple of banks? Because, the only way to pay back any loans is by producing real goods or services. The interest rates are created superior to the anticipated output of the production a given nation. When the nation can’t pay it’s debt in full then the financial powers begin to influence every area of policy—and I do mean EVERY area. I don’t think it’s a coincidence that our money reads “In God We Trust.” Because indeed, in God we DO trust. Isn’t it ironic that the vile perpetrators of this scam would use such a sacred claim in an effort to make us feel more trusting and confident in this charade?

OK. So what can you do to break away from relying on such an empty scam? What I keep telling you. Put your faith and trust in real and tangible goods and services and NEVER allow yourself to pay interest–that will represent true wealth. I have invaded some of the most lofty circles of this deception myself over the last 15 years. I have heard their plans and their shifty reasoning. I have seen them claim that $1 billion dollars is suddenly worth $1.2 billion after a mere 24 hours, and ashamedly I bought into it all thinking that I was somehow superior to others because I knew how money works. Hah! I knew how money was portrayed to work, but it was a big wake up call after I discovered how it really “worked.” After falling for the façade of interest and compounding I finally was beaten. Having to start over I vowed that I would NEVER, EVER allow myself to play the interest bearing game again. I hope you will do the same as wisely and as speedily as is prudent.

- Financial Preparedness Part I — Conspiracy Abounds

- Financial Preparedness Part II — The Conspiracy Players

- Financial Preparedness Part III — The Ultimate Deception

11 Comments

TODD · November 17, 2009 at 6:50 pm

I’m not sure I agree with all your points.

When the bank loans money for the cruise they enabled the cruise to take place, without the loan the people would have stayed home. I agree it is dumb on their part to borrow money for vacation. However the people are paying a fee to take the trip before they earned the money. That isn’t theft. Its the same as wal-mart selling a rubbermaid bin for $10 when it buys them for $5, they didn’t produce the good, yet made a profit on it.

If I have money, or a tractor, and I lend it out, why is it different if I earn interest or a rental fee? If the loan allows the person to buy their own tractor and produce work?

When you put your money into the bank it does do work, it buys houses, cars, and vacations. People pay a fee to do those things now instead of later. Is it smart to pay the fee? Not always, I still don’t understand how that is theft? Honestly when you put money into a savings account you should be told it isn’t available for withdrawl. Like you said the banks don’t have it, the loan it out.

The theft happens when the FED prints new money and lends it to banks at super low rates, they then loan it at higher rates. That’s theft, if a bank is using deposits I don’t think it is. Printing money from nothing like the FED does isn’t the same as charging a fee to borrow money. You are paying for time.

Kellene · November 17, 2009 at 7:08 pm

Todd, I appreciate you taking time to make a comment and I certainly respect anyone’s desire to disagree with me. At the risk of sounding like a “wife”–the only problem with your comment is that it is incorrect. I mean absolutely no disrespect in my response to you. But you are incorrect on so many layers with your comment. It’s not a personal default, of course. It’s simply a lack of comprehension of how money really works. I’m positive you will see things a bit differently were you able to study this topic more. The lack of accountability in the printing of money is only a portion of the problem.

The most erroneous part of your statement is your belief that banks loan money out. Banks don’t loan money out, Todd. They provide electronic digits and it keeps going and going and going. It’s a matter of bookkeeping, not a possession of money. As shared in the article, they only have EIGHT percent of the real money on hand. They are lending 92% AIR. And they are charging an interest on that air.

Also, you can’t possibly substantiate a claim that charging an interest on 92% air, even for a cruise, is a contribution to society. It’s merely a perpetuation of the fraud.

It’s ludicrous for someone to work to earn money (a true contribution to the economy), only to be told that they can’t withdraw it from a savings account. What kind of a free country would that be if that was a requirement on something as simple as a savings account? There’s already a “fee” assessed if someone was to do something of that sort with a CD.

You stated that the Fed loans money at “super low rates” to the banks. Define what such a rate is. If I were to “only” charge 1.5% on Monopoly money and simply told you that the money was there simply because I sent electronic digits to a bank, would that make the 1.5% super low rate or would it be ludicrous because I’m charging interest on something that isn’t really there?

Your belief that you are paying for time is simply a concession that you have bought into the facade. I’ve seen your comments over the months here. You’re an intelligent person. It’s simply that this fraud permeates all levels of society and intelligence. Understanding this issue is critical to everyone.

Ami · May 25, 2010 at 3:07 am

Anyone here that wants more information on what Kellene is talking about should read “Modern Money Mechanics” by the Chicago Federal Reserve. Another great source is “The Money Masters” DVD. You can Google both and find them fairly easily.

TODD · November 17, 2009 at 7:40 pm

hmm. I’m open to the fact that I could be wrong. I’m not sure I understand the entire argument though. Is it just banks or any loans or any interest in general?

I understand the banks transfer electric accounts, however if they did physically transfer funds would it make a difference? I say super low meaning %.25 or less. Then lend goldman Sachs $10 Billion for that and they loan it out for 10%, the problem is it is new money, money that didn’t exist before. This drives inflation. There are two differences though, printing money and lending it and savings that are lent. I fail to see the problem with lending out saved money and collecting a fee for giving up its use for that time period.

Like you said in the article, money is a representation of goods. If I have a bushel of wheat and lend it to you for 5 years. For me giving up that use of the wheat for 5 years you agree to give me two bushels payment. That is fair, you had use of the wheat and grew produce and paid a portion to me. So now. Wheat costs $5, I lend you $5 to buy it and in five years you pay me $10. You take the $5/wheat and grow and make money. My money/wheat increased.

I don’t understand why that is different than money in a bank?

You earn interest on your savings account because you agree to let the bank lend it out. It’s not realistic to expect that money to be available. If banks kept 100% reserve you would have to pay bank fees each month and you couldn’t earn interest. You are being paid to give up access to your money. Most people don’t think about it but that is what a bank does. If you want instant access to all your funds, keep it at home.

All that said I think the printing game the FED does is horrible. That is truly making money from nothing.

Can you use my wheat example to explain what I’m missing?

jamie · November 21, 2009 at 3:24 am

Todd I think you are thinking of trading Tangible assets. The Fed and the Markets engage in speculation of what those tangible assets will be worth in the future.

Now I know in spite of all that is said that grain is getting more scarce. The less there is of an Item the more it costs. Now you lend me a bushel of wheat at $5.00 and I sell it to a farmer at $20.00 cause he’s got a guy that will buy it at harvest time for $40.00 because he thinks wheat will go to $50.00 per bushel. But what we are doing is gambling that the price will go up.

Now any number of things can happen

1. The Fed prints more fiat paper money. Inflation (Weinmar Republic, Nigeria, 1970’s USA) Money loses it’s value.

2.Government price controls. The government sets the price for wheat and it’s $2.50 per bushel. Yes the US of A has done this and inflated it’s money.

Now those are 2 simple scenarios that have happened in the past. All those folks betting on a higher price are wiped out and declare bankruptcy. I’m wiped out and can’t give you your money. So you have lost all that value of wheat.

That’s what they mean about paper profits. It’s not real unless it’s in your hand.

It’s like what we have going on with corn. The US government has mandated that gasoline be 10% ethanol, most comes from corn. So now corn has gone up in price. Corn is used a lot in feeding meat animals. So the price of meat, milk and eggs goes up. Then you get “Swine flu”, or folks won’t pay higher price and cut back because they can’t afford the higher cost because of job loss or Mortgage payments jumped because of Balloon payments, or the state has decided to raise withholding by 10% because they need the money.

What’s fair is irrelevant. Markets decide the price. I’d like to eat Lobster, but it’s to darn expensive. Heck I remember when Ribs and Brisket were the cheap cuts now they are pretty expensive compared to what they used to be, because folks are buying them more for BBQ.

It’s still supply and demand. Just when the Governments interfere they create all kinds of unintended consequences.

TODD · November 24, 2009 at 6:39 pm

I agree with most of what you are saying. I do still think that interest by itself doesn’t equal theft. That doesn’t mean what the fed is doing isn’t theft.

I’ve been giving this a lot of thought. When you say we have a 8% reserve. Does that mean that only 8% of the money actually exists? What I mean is. Say we have 1 trillion dollars as total currency. Is there an actual paper dollar for all of that? Is there where the electronic numbers come into play?

Also I totally agree our money system is hosed..

The only point I was trying to make is that you can truely earn interest by lending out your goods. And as just stated there is risk with it. I could lend you the wheat and the entire harvest fails.

Kellene · November 24, 2009 at 6:53 pm

Todd, assessing a fee to use wheat is completely different because the wheat actually exists. The theft comes when you are charging interest on something that doesn’t exist–air. Does that make better sense?

Regarding the 8%… the bank is permitted to lend 92% of what they have on deposit. As you know, that deposit amount varies daily and yet the banks aren’t required to call back any loans as a result. Meaning, you deposit $100. The bank can then lend to someone else 92 dollars, even though it’s your money. And when you come to withdraw that money to go on a trip to Disneyworld, the bank isn’t required to recall the loan. It still stays in place. And since so much of what we deal with in our monetary system is digital today, it makes the farce of charging interest that much more offensive. Hope I’m making more sense for ya.

Ami · May 25, 2010 at 3:12 am

You could also say that the banks are practicing usury (using the old definition: interest paid for the use of money), which is illegal. However, the government has changed this slightly to make it ok for banks to do it.

TODD · November 25, 2009 at 4:45 pm

I’m willing to admit defeat, I don’t get it. That is ok though.

I don’t think it is critical that I do. I’m already taking the steps you listed because they make sense.

jamie · November 26, 2009 at 4:58 am

Todd I think your (fundamental issue) is you are a basic capitalist. You see how you can get value and money from basic goods. You think logically. The problem is Government intervention that skews the market. Farmers getting paid for not planting, to drive up prices, subsides for some crops and not others.

We have oil tankers sitting off shore in many countries hoping the price oil will go up. We have an oil glut right now but these guys are holding out for the highest price they think they can get. I don’t blame them, but many of them bought “futures” in oil and they will lose money unless the price of oil goes up.

Remember money is a commodity just like wheat,oil, and gold.More money out there the less it is worth. Just remember money is based on faith/confidence.

Kellene · November 28, 2009 at 10:22 pm

Remember, money is NOT a commodity. It was never intended to be a commodity. It was never approved to be a commodity. It was supposed to simply be a universally recognized representation of one commodity for another.

Comments are closed.