OK. I admit it. I do have a few pet peeves that really bother me. One of them is seeing my city’s municipal properties drowning their lawns in the middle of a rainy day when we live in the middle of a desert. I figure that it makes an impact in my taxes as well as the volatile water table that I rely on. The second peeve I have is when people leave their garbage in the movie theater as if it’s the employee’s responsibility to clean up after them. I mean really? You can’t lift that heavy EMPTY popcorn container and put it in the trash on your way out? I figure that if we all cleaned up for ourselves, then our ticket prices could go way down, which is a reasonable request since the level of entertainment has certainly decreased, eh? Lastly, I have a hard time with coupon shoppers who are clearly purchasing goods in a dishonest manner—we’ll call it working the system (I won’t tell you how this is done, because I don’t want to tempt anyone. *grin*). If you knew the method I’m speaking of you may share my sentiments that such abuse is no different than the blatant theft which causes my grocery prices to increase. So yeah, I do feel myself getting all ugly inside when I witness this kind of behavior. I see it as an infliction of harm on others, and the “heroine” in me has a hard time shrugging that off easily. Of course, I do try to sensor my judgmental feelings because they do me no good. But here’s a question for myself. What am I doing that is costing my fellow Americans a whole lot of money? I’m not talking about $50 here. I’m talking about hundreds of billions of dollars. And the unfortunate part is that my research shows that 97% of you are actually my accomplices in this act. Oh boy!

OK. I admit it. I do have a few pet peeves that really bother me. One of them is seeing my city’s municipal properties drowning their lawns in the middle of a rainy day when we live in the middle of a desert. I figure that it makes an impact in my taxes as well as the volatile water table that I rely on. The second peeve I have is when people leave their garbage in the movie theater as if it’s the employee’s responsibility to clean up after them. I mean really? You can’t lift that heavy EMPTY popcorn container and put it in the trash on your way out? I figure that if we all cleaned up for ourselves, then our ticket prices could go way down, which is a reasonable request since the level of entertainment has certainly decreased, eh? Lastly, I have a hard time with coupon shoppers who are clearly purchasing goods in a dishonest manner—we’ll call it working the system (I won’t tell you how this is done, because I don’t want to tempt anyone. *grin*). If you knew the method I’m speaking of you may share my sentiments that such abuse is no different than the blatant theft which causes my grocery prices to increase. So yeah, I do feel myself getting all ugly inside when I witness this kind of behavior. I see it as an infliction of harm on others, and the “heroine” in me has a hard time shrugging that off easily. Of course, I do try to sensor my judgmental feelings because they do me no good. But here’s a question for myself. What am I doing that is costing my fellow Americans a whole lot of money? I’m not talking about $50 here. I’m talking about hundreds of billions of dollars. And the unfortunate part is that my research shows that 97% of you are actually my accomplices in this act. Oh boy!

Do any of you take any satisfaction in the fact that you don’t abuse the welfare system and stand on your own two feet? Perhaps you take pride in the fact that you don’t owe any family or friends a penny? Perhaps you can be relieved that you’re not one of those people who file false workman’s compensation claims? Or at least you’re not the CEO of Enron or Goldman Sachs, or AIG and thus not responsible for fleecing Americans 10 generations deep? I’ll admit it. I do take some level of pride in all of that. At least I did until I realized that I was a willing thief to my neighbors’ financial strength. The fact is that until I was able to give up a really bad habit, I wasn’t anywhere near as expensive of a liability to my nation as my city’s water bill was to me. So, what wrong have I committed along with so many other adults? I used credit cards.

Debt Habits

Debt Habits

Ok. Now before you roll your eyes, no, this isn’t going to be another one of those “get out of debt now” articles. I have no allusions of grandeur in believing that I’m the first one to espouse such wisdom and am suddenly capable of getting you to change your debt habits when no one else could. Obviously you’ve heard the “get out of debt” message before, but for some reason you’re still using them. In fact, it’s an interesting trend we’re seeing as of late. Thanks to so many being upside down in their home mortgages, more and more Americans are actually paying their credit cards before their mortgages—why? Because they have to live off of their credit cards and they’ve stopped caring about carrying a mortgage on a worthless asset. These desperate people reason that they can stay in the good graces of 4 or 5 credit card grantors OR they can pay one “greedy little SOB who didn’t earn their money.” Which would you pick in desperate times? For many families in our nation, their credit cards feed and clothe them. If you haven’t been there, it’s quite likely that you know someone who has.

About 40 years ago, the average number of credit cards in a home was one. Today, it’s 5.6. (In New Hampshire or New Jersey, that average number is TEN!) Nearly 50% of the WORLD’S Visa cards are held by Americans! It’s no coincidence that one of the poorest cities in our nation, Jackson, Mississippi, also holds the highest amount of credit card debt to income ratio in the U.S. There are over 1.5 BILLION credit cards in the U.S. right now. Alarmingly, this number increases to SIX for persons who are retired and on a fixed income. Some families actually count their available balance as a financial asset in their monthly budget! Ok. So where’s the crime in all of this? Bear with me for just a moment.

About 40 years ago, the average number of credit cards in a home was one. Today, it’s 5.6. (In New Hampshire or New Jersey, that average number is TEN!) Nearly 50% of the WORLD’S Visa cards are held by Americans! It’s no coincidence that one of the poorest cities in our nation, Jackson, Mississippi, also holds the highest amount of credit card debt to income ratio in the U.S. There are over 1.5 BILLION credit cards in the U.S. right now. Alarmingly, this number increases to SIX for persons who are retired and on a fixed income. Some families actually count their available balance as a financial asset in their monthly budget! Ok. So where’s the crime in all of this? Bear with me for just a moment.

Debt in the Monetary System

As you may have heard me harp about previously, the amount of currency in circulation in comparison to the available goods and services is what determines our financial health. Think of it as the percentage of body fat to muscle in a human. Obviously, a body that is 58% body fat is ripe for a heart attack, diabetes, arthritis, and a compromised immune system. The problem with our monetary system at present though is that unlike the amount of fat in our body, we have no primary way to determine just how much is in circulation. We can identify the amount of goods and services produced in a given year, but the Federal Reserve has conveniently halted its production of the M3 report, which is what published the information about the amount of currency that was issued into our market each year. For several years now, we’ve been flying blind, so to speak. So instead of an M3 report, we need to look at other factors which can be nearly as useful as an M3 report, although surely on a conservative level. (It’s interesting though, that the Federal Reserve has no problems regularly publishing the amount of debt though. Natch.)

Bear with me. There’s one more fundamental aspect of economics that I must establish in order for the light bulb to turn on for everyone. The real value of any nation is based on what it produces—preferably in the form of tangible goods such as food, clothing, real estate, etc. America quickly became the financial powerhouse that it is because of the significant amount of hard goods that it was able to produce and export to the rest of the world. It was in part this very reason that the U.S. dollar became the standard in currency markets worldwide, the U.S. had more tangible production to show for their work versus other nations. So long as hard goods continue to get produced and sold, then a nation is not in anywhere near as much financial peril as they would be if they just kept printing money and making up intangible things to spend it on. Let me restate that. Even though money is being printed with reckless abandon, if it’s at least chasing hard, visible, goods, it’s bearable to just about any economy. However, when money is created out of thin air, backed by nothing other than a “Because I Said So” signature, and is spent on nothing tangible, then the path to serious financial failure is imminent. The reason being is that when it comes to not having anything to show for it, the useless money becomes even more of a thief by appearing in useless, intangible forms—say, digits on a computer screen. Think about it. I’m sure that I wasn’t the only one who had a brother who went through cash like it was water with NOTHING to show for it. He was always broke. Now, picture an entire nation like that.

Bear with me. There’s one more fundamental aspect of economics that I must establish in order for the light bulb to turn on for everyone. The real value of any nation is based on what it produces—preferably in the form of tangible goods such as food, clothing, real estate, etc. America quickly became the financial powerhouse that it is because of the significant amount of hard goods that it was able to produce and export to the rest of the world. It was in part this very reason that the U.S. dollar became the standard in currency markets worldwide, the U.S. had more tangible production to show for their work versus other nations. So long as hard goods continue to get produced and sold, then a nation is not in anywhere near as much financial peril as they would be if they just kept printing money and making up intangible things to spend it on. Let me restate that. Even though money is being printed with reckless abandon, if it’s at least chasing hard, visible, goods, it’s bearable to just about any economy. However, when money is created out of thin air, backed by nothing other than a “Because I Said So” signature, and is spent on nothing tangible, then the path to serious financial failure is imminent. The reason being is that when it comes to not having anything to show for it, the useless money becomes even more of a thief by appearing in useless, intangible forms—say, digits on a computer screen. Think about it. I’m sure that I wasn’t the only one who had a brother who went through cash like it was water with NOTHING to show for it. He was always broke. Now, picture an entire nation like that.

So, now let’s take a look at credit cards. When a credit card is issued to a person, it’s not in exchange for anything initially, right? If you have the lucky numbers on your credit report, or if you have a pulse in some cases, you get one. (Ironically though, last year over 1.2 million “pre-approved credit card” offers were awarded to deceased persons or pets!) Even for those cards which charge a fee for their “privileged use”, nothing tangible is circulated into the economy. Worse yet, there are numerous fees associated with credit card use AND possession. Yes, this means that even those who pay off their credit card every month, are still feeding the problem. Last year, over $20.9 BILLION dollars were charged to consumers for “over the limit” fees. Another $15 BILLION was charged to hardworking consumers for the privilege of having a credit card. Hmmm…plastic has never been so valuable, eh? Remember, I’ve not even addressed the interest earned on these credit cards. Let’s take that aspect on now.

So, now let’s take a look at credit cards. When a credit card is issued to a person, it’s not in exchange for anything initially, right? If you have the lucky numbers on your credit report, or if you have a pulse in some cases, you get one. (Ironically though, last year over 1.2 million “pre-approved credit card” offers were awarded to deceased persons or pets!) Even for those cards which charge a fee for their “privileged use”, nothing tangible is circulated into the economy. Worse yet, there are numerous fees associated with credit card use AND possession. Yes, this means that even those who pay off their credit card every month, are still feeding the problem. Last year, over $20.9 BILLION dollars were charged to consumers for “over the limit” fees. Another $15 BILLION was charged to hardworking consumers for the privilege of having a credit card. Hmmm…plastic has never been so valuable, eh? Remember, I’ve not even addressed the interest earned on these credit cards. Let’s take that aspect on now.

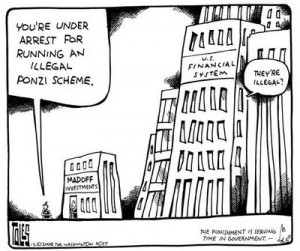

We all assume we know what happens when a credit card is used. I purchase $1,000 of household furnishings at my local House Mart. Instead of paying cash for it though, I use a credit card. House Mart delivers the goods to my home and then send the credit card receipts to their merchant (digitally). Within a couple of days, the merchant sends digits into House Mart’s bank account. House Mart then pays their employees, vendors, taxes, rent, and all other expenses as a result of these digits which they see on their computer screens when the log into their bank account. So yeah, I get drapes, end tables, and a dining room table and some throw rugs, but no one else has received anything tangible in exchange for that, right? Now let’s follow those digits. Employee A receives his weekly amount of digits in his bank account. He then goes about town paying for his groceries, gasoline, taxes, and mortgage with those digits, right? Still, nothing tangible is exchanged. House Mart uses their digits to pay their vendors who then turn around and use their digits to pay their supplies in China. Still, nothing tangible, not even our worthless paper money here. But that’s not the most alarming part. The fact is that credit card companies are playing a true ponzi scheme with a very thin margin for error. If they grant me a $1,000 credit line, they are only required to have SIXTY to EIGHTY actual dollars (in the form of digits, of course) on hand to do so. So, even if House Mart demanded that they not get paid in digits, but in actual dollars, Credit Card USA could not do it. The ponzi scheme would unravel.

We all assume we know what happens when a credit card is used. I purchase $1,000 of household furnishings at my local House Mart. Instead of paying cash for it though, I use a credit card. House Mart delivers the goods to my home and then send the credit card receipts to their merchant (digitally). Within a couple of days, the merchant sends digits into House Mart’s bank account. House Mart then pays their employees, vendors, taxes, rent, and all other expenses as a result of these digits which they see on their computer screens when the log into their bank account. So yeah, I get drapes, end tables, and a dining room table and some throw rugs, but no one else has received anything tangible in exchange for that, right? Now let’s follow those digits. Employee A receives his weekly amount of digits in his bank account. He then goes about town paying for his groceries, gasoline, taxes, and mortgage with those digits, right? Still, nothing tangible is exchanged. House Mart uses their digits to pay their vendors who then turn around and use their digits to pay their supplies in China. Still, nothing tangible, not even our worthless paper money here. But that’s not the most alarming part. The fact is that credit card companies are playing a true ponzi scheme with a very thin margin for error. If they grant me a $1,000 credit line, they are only required to have SIXTY to EIGHTY actual dollars (in the form of digits, of course) on hand to do so. So, even if House Mart demanded that they not get paid in digits, but in actual dollars, Credit Card USA could not do it. The ponzi scheme would unravel.

Now, let’s consider that there is presently over $850 BILLION dollars in credit card debt currently owed. There is also an average of 14.48 percent of APR charged on that debt. This means that each year Americans are exchanging real labor in order to pay over $126 billion in credit card interest. So, let’s just take a quick M3 kind of look here. $126 billion in interest, plus $20.9 billion in over limit fees, plus $15 billion in possession fees. That equals $161 billion of intangible services that Americans are exchanging for their real labor. See the problem?

Now, this gets even worse when you take into consideration the amount of bad debt that is “written off” each year by the credit card companies. “Written off.” Exactly what does that mean? All it means is that the credit card companies are now able to limit their amount of taxable income by the amount that is “written off” via bad debt, delinquencies, or bankruptcy. So, yes, because someone files bankruptcy, that means that an obligated corporation pays less in taxes. Vicious, eh? Nearly twenty four BILLION dollars of credit card debt was written off last year as the result of bankruptcy or other type of delinquency. So, not only do we have all of those digits being created out of thin air, but we make almost a third of those digits USELESS through defaults.

Are you seeing the problem here? Credit card usage is VOLUNTARY  INFLATION. Inflation affects all of us—employed, unemployed, over paid, rich or poor! Feeding the credit card beast which thrives among the world of the Federal Reserve and our banking system is akin to ensuring a heroine addict has Carte Blanche access to the Mexican drug cartel, only much more convenient. So yes, debt is harmful in oh, so many ways, but the use of a credit card is an even more vicious offender to the sanctity of our currency value. It’s worse than drinking the Kool-Aid folks. It’s drinking it AND watering it down to nothing!

INFLATION. Inflation affects all of us—employed, unemployed, over paid, rich or poor! Feeding the credit card beast which thrives among the world of the Federal Reserve and our banking system is akin to ensuring a heroine addict has Carte Blanche access to the Mexican drug cartel, only much more convenient. So yes, debt is harmful in oh, so many ways, but the use of a credit card is an even more vicious offender to the sanctity of our currency value. It’s worse than drinking the Kool-Aid folks. It’s drinking it AND watering it down to nothing!

We may not be able to get Congress to hold the Federal Reserve accountable any time soon, but we DO have the power to starve the Kraken! When you exchange hard work for credit card use then you discount all of what you produce for society. It’s akin to offering yourself, and that of your loved ones to be raped and pillaged by the lowliest of fiends, and paying them to do it. After all is said and done, it’s the quality of life that you give yourself that you can rely on, not the hand outs, praise, or “Black Diamond” privileges from others. So, for the sake of yourself, your family, and your fellow Americans, burn up those credit cards and never let them adulterate your honest work or the value of your nation again!

For more credit card statistics, visit http://www.creditcards.com/credit-card-news/credit-card-industry-facts-personal-debt-statistics-1276.php

7 Comments

Emily · September 2, 2010 at 5:26 pm

We are a credit card free household but I never thought of it from that point of view. Interesting.

Janet · September 2, 2010 at 8:53 pm

We have a few of the little stinkers. We only use one, it has no fees, we get a nice rebate on it, and pay it off monthly. Because it doesn’t cost us anything and we actually make a profit off of it, I consider it much like couponing. We have no debt, other than mortgage. Am I evil or smart?

Kellene · September 2, 2010 at 9:54 pm

I certainly would not be in a position to label you as evil. But my opinion is deep-rooted enough that I believe anything which feeds the beast is not healthy for our economy.

Louise · September 3, 2010 at 3:48 pm

A couple of years ago when I tried to lower my limit on my one credit card and after an hour on the phone with the company was unable to I cancled it. Since then I have been happily credit card free. My boyfriend just commented that they upped his interest and he’ll be canceling his. I think this post is right on track and is in line with the going to cash transactions. Don’t forget to teach your children this wisdom. They make toy credit cards and you can get a Monoply game with all credit card transactions. Society teaches them young, so make sure that you do as well.

Bonnie · September 4, 2010 at 2:13 am

And for those people who know they should get out of credit card debt, and keep sabotaging their own efforts, http://www.debtorsanonymous.org/ may be of help.

jamie · September 6, 2010 at 1:11 am

I got credit card free about 2 years ago. It can be a bit hard to work around but it does exist. Sears and K-mart have an 8 week layaway program. Many Pawn shops and smaller stores have a layaway for 3 months. I don’t get to play right away with the latest toy. But there is no interest of any sort. AWESOME!!

I’m doing great on putting stuff on layaway at sale prices. Then pay them off in a couple of months. Beats the heck out of credit card rates.

I got used to working with internet banking in the Army but I’m trying to have a bit of cash on hand and a few silver coins that anyone could take if needed.

I’d say have $20.00 in greenbacks, $20.00 in quarters for vending, $20.00 in a a coin of anytype that is backed by gold or silver or is gold or silver.

Kellene · September 9, 2010 at 7:46 am

Congrats!

Comments are closed.