Bishop

Live your life. Don’t leverage it.

In the world of “emergency preparedness” which any regular reader of mine will know that I don’t subscribe to, it is common to hear proposals to “get off the grid.” Typically what that entails is someone living via their own food, water, and electric production. In some instances it may even encourage a hermit type of lifestyle. Well, in understanding reality, I believe that the hermit aspect of being off the grid is unrealistic. People, by nature, are a social lot thus making self-imposed exile unrealistic. However, we still have the right and even a duty to be very particular of the company we keep, right? So today, I’m going to point out some villainous low lifes, that I recommend you cease associating with as soon as possible. Unfortunately, I realize this will not be an easy task. You have already allowed them not only into your living room, but they eat frequently at your kitchen table, they sleep with you every night, and indeed, they attempt to blackmail you into making the kinds of decisions that place you and your family into slavery—yes, real life, legal slavery. Even worse, these untoward influences which you opt to keep in your life have manipulated the majority of your friends and family members in exactly the same manner.

In the world of “emergency preparedness” which any regular reader of mine will know that I don’t subscribe to, it is common to hear proposals to “get off the grid.” Typically what that entails is someone living via their own food, water, and electric production. In some instances it may even encourage a hermit type of lifestyle. Well, in understanding reality, I believe that the hermit aspect of being off the grid is unrealistic. People, by nature, are a social lot thus making self-imposed exile unrealistic. However, we still have the right and even a duty to be very particular of the company we keep, right? So today, I’m going to point out some villainous low lifes, that I recommend you cease associating with as soon as possible. Unfortunately, I realize this will not be an easy task. You have already allowed them not only into your living room, but they eat frequently at your kitchen table, they sleep with you every night, and indeed, they attempt to blackmail you into making the kinds of decisions that place you and your family into slavery—yes, real life, legal slavery. Even worse, these untoward influences which you opt to keep in your life have manipulated the majority of your friends and family members in exactly the same manner.

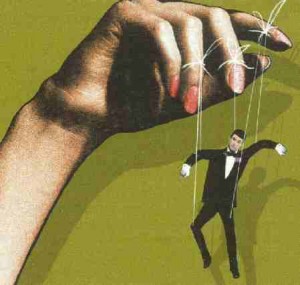

Before I reveal who these nefarious persons are, allow me to ask you a question. Isn’t it accurate that a blackmailer has no influence if you do not have an attachment to whatever it is that they hold over your head? For instance, suppose a blackmailer threatens to tell and demonstrate to your entire community that you are a horrible wife and mother if you do not comply with their demands. Logistically speaking, that blackmail threat only has power over your actions if A) you believe that your image can convincingly be portrayed in such a manner and B) if you believe that your life will be affected negatively, even irrevocably, if this information were to get out. However, if neither A nor B play a part in your decision, then you automatically thwart any power that the blackmailer has over you. You may even go so far as to take out a front page ad in your local newspaper that says “I’m a bad wife and mother—get over it. At least I can improve.”—or something like that. Obviously, such a response to a threat of blackmail would definitely take the wind out of the sails of any potential extortionist. In fact, late night host, David Letterman, did just that when one of his producers threatened to “go public” with a litany of affairs he knew David Letterman had engaged in over a span of years. Instead of giving in to the proposed extortion game, David Letterman elected to break the news of his infidelity himself—thus destroying any untoward influence the would-be extortionist had over him.

Before I reveal who these nefarious persons are, allow me to ask you a question. Isn’t it accurate that a blackmailer has no influence if you do not have an attachment to whatever it is that they hold over your head? For instance, suppose a blackmailer threatens to tell and demonstrate to your entire community that you are a horrible wife and mother if you do not comply with their demands. Logistically speaking, that blackmail threat only has power over your actions if A) you believe that your image can convincingly be portrayed in such a manner and B) if you believe that your life will be affected negatively, even irrevocably, if this information were to get out. However, if neither A nor B play a part in your decision, then you automatically thwart any power that the blackmailer has over you. You may even go so far as to take out a front page ad in your local newspaper that says “I’m a bad wife and mother—get over it. At least I can improve.”—or something like that. Obviously, such a response to a threat of blackmail would definitely take the wind out of the sails of any potential extortionist. In fact, late night host, David Letterman, did just that when one of his producers threatened to “go public” with a litany of affairs he knew David Letterman had engaged in over a span of years. Instead of giving in to the proposed extortion game, David Letterman elected to break the news of his infidelity himself—thus destroying any untoward influence the would-be extortionist had over him.

Ok. So what’s all of this talk today of blackmailers, villains, and low lifes, and what in the world does it have to do with the subject of preparedness?

If I had my druthers, I would wish for every person to see the credit reporting culture for what it truly is. I believe that if you were to do so, then you could easily dismiss its unnecessary influence in your life, and that you would be living a much more independent and true version of yourself. Grant it, this is much easier said than done. Some persons say that the drug addiction to heroine is nearly impossible to overcome. Other doctors say that sugar is just as addictive of a habit. But I say that the use of credit and the consequential influences of using that credit, rank right up there in terms of difficulty to overcome. So my goal today is to give you some sound “whys” so that you can be better armed in your release from this enslavement.

Credit reporting has influenced our lives in nearly every aspect. In spite of the fact that every American has the right to work, someone, somewhere elected to give the credit reporting agencies the right to weigh in on whether or not we would be a good employee. In spite of the fact that many of us elect not to participate in the rat-infested waters of the credit card game, someone, somewhere decided that if we do not play in this game, that we are less than perfect and thus receive a lower credit score. Even more manipulative, if we simply choose to have a credit card, but not use it because we are wise and self-sufficient, we are considered still not fit to receive an approval rating of the credit reporting monarchy. It doesn’t matter that you were unable to afford an attorney when a frivolous law suit was thrown at you, and as a result you got behind on your bills. It doesn’t matter that your insurance company elected to play games with your medical claims when you had an emergency triple by-pass. It doesn’t matter that some $7 an hour employee was distracted with a benign cell phone conversation and made a mistake when they reported your credit payment history. The credit reporting oligarchy does what they want, why they want, when they want, and they have somehow convinced every employer, insurance company, and extender of private person credit that they are the authority on who you are or are not. Hmmm…. Doesn’t this make you want to ask “who made YOU the authority on my character, heart, and soul?

Credit reporting has influenced our lives in nearly every aspect. In spite of the fact that every American has the right to work, someone, somewhere elected to give the credit reporting agencies the right to weigh in on whether or not we would be a good employee. In spite of the fact that many of us elect not to participate in the rat-infested waters of the credit card game, someone, somewhere decided that if we do not play in this game, that we are less than perfect and thus receive a lower credit score. Even more manipulative, if we simply choose to have a credit card, but not use it because we are wise and self-sufficient, we are considered still not fit to receive an approval rating of the credit reporting monarchy. It doesn’t matter that you were unable to afford an attorney when a frivolous law suit was thrown at you, and as a result you got behind on your bills. It doesn’t matter that your insurance company elected to play games with your medical claims when you had an emergency triple by-pass. It doesn’t matter that some $7 an hour employee was distracted with a benign cell phone conversation and made a mistake when they reported your credit payment history. The credit reporting oligarchy does what they want, why they want, when they want, and they have somehow convinced every employer, insurance company, and extender of private person credit that they are the authority on who you are or are not. Hmmm…. Doesn’t this make you want to ask “who made YOU the authority on my character, heart, and soul?

Even worse, the credit reporting network has somehow been given permission to “rate” you with a number, without any real boundaries, accountability, or any amount of required accuracy. It’s interesting to note that out of every single erroneous bit of information that the credit reporting agencies have published about you, it was NEVER in your favor. Every mistake made by Transunion, Equifax, and Experian (the big three reporting agencies) was never made in such a way that your credit position was improved. Mistakes like this do not happen unless you have a derogatory system in place to begin with. In addition, out of 1,000 credit reports that were sampled, over 25% of them had errors—serious errors—that cost you your job, a larger portion of your paycheck, or your ability to obtain affordable insurance. These self-sanctioned reporting agencies are owned by the very persons who benefit from you having a less-than-stellar credit score—the banks. Think about it. When your score is lower, the banks “get to” charge you a higher interest rate.

Credit reporting agencies also get to pry into our lives without our permission. Seriously, have you ever given anyone the authority or permission to pry into your work history, medical history, or debt history before? No. Is this supposed to be public information? Uh, no. And yet I can tell you right now that the information on your credit report is sold with reckless abandon to any business who desires it. I know. Because I used to be one of those businesses who bought your credit information! I could look through anybody’s credit report and figure out the majority of their life story! The credit reporting agencies have all of that information on you, and then have the gall to charge other persons—including yourself—to view such information!! They are profiting on the manipulation and disbursement of your private information. Even worse, they have convinced everyone that this is “normal” and “just how it’s done.”

Credit reporting agencies also get to pry into our lives without our permission. Seriously, have you ever given anyone the authority or permission to pry into your work history, medical history, or debt history before? No. Is this supposed to be public information? Uh, no. And yet I can tell you right now that the information on your credit report is sold with reckless abandon to any business who desires it. I know. Because I used to be one of those businesses who bought your credit information! I could look through anybody’s credit report and figure out the majority of their life story! The credit reporting agencies have all of that information on you, and then have the gall to charge other persons—including yourself—to view such information!! They are profiting on the manipulation and disbursement of your private information. Even worse, they have convinced everyone that this is “normal” and “just how it’s done.”

Here’s an example. Recently a medical collections company shared with me that nearly all of their collection accounts will settle an account without even checking to verify that the medical collection is accurate, rather than have it negatively affect their credit report. I don’t know what you call it in your world, but in my world folks, that’s called a shake down. A recent news article in the New York Times reported that several banks delay reporting positive payment behavior in order to protect themselves from losing their good clients to other banks, and in order to justify their present interest rate.

In spite of the great amount of power and influence that the credit reporting agencies have self-proclaimed, there are very little consequences for their inaccuracies, inherent vulnerabilities for identity theft, and downright fraud. With the errant press of a button, a person’s life who is reliant upon credit can come to a screeching halt. No checking account. No mortgage. No automobile. Etc.

So, you know what I say? Stop playing the game with them. Stop giving them permission to use you as a profit center. Stop acknowledging them as any kind of authority in your life.

So, you know what I say? Stop playing the game with them. Stop giving them permission to use you as a profit center. Stop acknowledging them as any kind of authority in your life.

Did you know that you are not required to give a bank your social security number? Just because they are required by law to ask you for a social security number, does not mean that they are required to RECEIVE your social security number in order to open an account. (See U.S. Code Title 26). This is exactly why I do not have any credit cards, car loans, etc. I will never even apply for a credit card or line of credit. If my husband and I want a car, we will pay cash for it. When my husband’s business needs more product, he pays for it up front, never taking it on “15 day terms.” If you don’t play their game, then they have no control over you. When I buy a new house, it will be with cash or I will lease/rent to own. I will never provide my social security in order to obtain medical care. You are NOT required to have a social security number. (See Social Security Act). And if you’re paying cash for your medical care, then what business do they have of demanding this number from you?

“Mr. Smith, if you don’t have this many kinds of credit cards open for this period of time, you will have a poor credit score.”

Mr. Smith should say “So what? I don’t use credit and I never will.” That, my friends, is how you become financially independent. And only if you are financially independent do you become independently wealthy. Any other kind of wealth is a mythical state of belief. How can you truly be independent if you are indebted to any other person?

You may not be aware of this, but this credit crap shoot does not apply to the commercial world. Yup. In the commercial world of lending a credit score is a moot point. All the underwriters focus on is the value of the collateral, the viability of the business plan, and the experience of the business owners. No credit score required. Hmmm…doesn’t that make you wonder just a little bit? It’s ironic that the whole credit reporting scheme got it’s start as a way to grade business risks. And yet now, it’s rarely used for that purpose. Instead it’s used to get everyday persons like you and I to cow tow to some made up, unexplainable (literally—it’s unexplainable even by those who run the business), secret, scheming system. That may sound dramatic to some of you. But just because it has some illicit taste, does not detract from the fact that I’m 100% correct in this matter.

You may not be aware of this, but this credit crap shoot does not apply to the commercial world. Yup. In the commercial world of lending a credit score is a moot point. All the underwriters focus on is the value of the collateral, the viability of the business plan, and the experience of the business owners. No credit score required. Hmmm…doesn’t that make you wonder just a little bit? It’s ironic that the whole credit reporting scheme got it’s start as a way to grade business risks. And yet now, it’s rarely used for that purpose. Instead it’s used to get everyday persons like you and I to cow tow to some made up, unexplainable (literally—it’s unexplainable even by those who run the business), secret, scheming system. That may sound dramatic to some of you. But just because it has some illicit taste, does not detract from the fact that I’m 100% correct in this matter.

I beg everyone who’s reading this to stop playing the credit game. Stop using credit cards. Stop purchasing what you cannot really afford. Every time you do, you are simply empowering the credit scheme to have effect on your life, and on everyone else around you. Only if you shake off the shackles of this sham can you enjoy true independence on every aspect of your life. Don’t meet the demands of your blackmailer, annihilate them first. *yup, I’m feeling like Clint Eastwood right about now—grin* And I’m here to tell you that yes, it is completely possible to live your life without the need of any credit.

Live your life. Don’t leverage it.

32 Comments

Shirley - Arizona · May 20, 2010 at 8:56 pm

Hi Kellene. This is the 1st time sending a comment so I hope you get it o.k.

regarding “sharing our food storage”. someone asked, “Do we HAVE TO share with our neighbor?” the answer was , “No, we GET TO share with our neighbor. When that happens, do I have them help themselves or do I get the food for them?

Thanks!

Kellene · May 20, 2010 at 9:08 pm

Shirley, never show your cards to your neighbor, verbally or physically. You provide them with goods when you desire to do so. I do believe in charitable preparedness. I have a specific number of people in mind that I would like to be able to help for up to year should a scenario require it. But even with all of my preparedness efforts, record keeping, sacrifice to purchase these items, it will not last for that number of people if I do not ration it with wisdom.

Thanks for the comment.

Lynn · May 20, 2010 at 10:04 pm

Oh my gosh! Who knew!?? I need to do some checking to see what the Canadian laws area about out social insurance numbers. (The equivalent of your social security numbers.)

Thanks for the amazing research you do.

Katie · May 20, 2010 at 10:05 pm

I have no credit cards, though I do have a debit card through my credit union. I’m hoping to keep it that way! It’s scary though, when medical bills loom and they refuse to take payments, or if you really need transportation and your car dies and you don’t have several hundred or thousand dollars saved up yet. Those are the two biggies I can see taking out credit for, though my plan is to never do so!

Cathie in Ut · May 20, 2010 at 10:55 pm

Yes, Kellene it is a game that people can choose to stay out of but sometimes there can be unintended consequences with the SS # thing. I sure hope that you are correct in that you don’t “have” to give it to your bank etc because it might trigger an audit on taxes…after all you MIGHT be some rich lady HIDING your wealth LOL The IRS has been given extraordinary powers without laws being passed but just granted and it could be very scary for someone to trigger that audit…just saying.

Thanks for all of your great thoughts and tips!

Kellene · May 20, 2010 at 11:20 pm

Ah, the so-called powers of the IRS. Yes, that’s another article for another day. They only have the power that we give them.

jamie · May 20, 2010 at 11:02 pm

I see these games going on, but why play? I’m sure all the credit card companies will pump you up that you are responsible(not like all those folks that took a bailout). You deserve this credit rating… Why?

I love sending back all those credit card opt in back in the heaviest envelope I can contrive. I haven’t gone to the brick method but I don’t get as many credit card offers.

I can live with layaways or saving up. Would a credit card be convenient to have on hand? yes a bit to convenient.

I actually had a card sent me for re-establishing my credit. All I needed to do is put $250.00 fees on my credit card 1st and then pay it off. Of course I was given a $300.00 limit.

I may have been born at night but it wasn’t last night.

Rick · May 20, 2010 at 11:03 pm

Kellene,

The preparedness sites and podcasts I listen to, only refer to “off the grid” as not being dependant on those sources of power, such as electric or natural gas, that can fail in a disaster. I’ve never heard of the “hermit” approach in reference to off the grid, althought those types do exist. Having strong community relationships you can rely on are key to surviving any disaster, whether personal or regional.

Your comments regarding credit are right on. Keep them coming!

jamie · May 21, 2010 at 12:08 am

Rick, I have seen several folks are head toward the hill types. Heck I was one for several years.

But I really believe in building a nieghborhood/community.

I can’t run I’m handicapped, or at least I’ll need a lot of help. Not complaining what is is. I hope to hold in place with all the great things Kellene has taught me, and I get to give to others.

I can’t say what your situation is, but maximise staying alive and reduce your expsorer to threats. Have a place to go, refugees never prosper.

Marci · May 21, 2010 at 1:18 am

So if you stop “playing the game”…don’t they already have your number from past credit reports and bank accounts? Is there any way to really “start over” with a “clean slate”?

Kellene · May 21, 2010 at 2:05 am

Marci, regardless of whether or not you never have a credit card, or applied for a loan, or been employed by someone else, there will still be a credit report on you. However, “not playing the game” is about disengaging from any concern or influence which a credit report may say about you. Just like my mom used to tell me “consider the source.” Well, I declare that the “source” is not to be trusted, ere go I will use other means of obtaining what I want and won’t give them any influence over my purchasing decisions. That’s as “clean” as it can be. We aren’t able to “opt out” of being in their system, unfortunately.

Charlie · May 21, 2010 at 1:45 am

Kellene,

This is my first time to read your blog – EXCELLENT! Spot on. We appreciate the advice. –

Come see us 🙂

Charlie

Kathleen · May 21, 2010 at 2:44 am

We went credit card free 8 years ago and are so much better for it.

I do have a P aypal account and owe $200. what was I thinking? Have to pay it off asap.

E bay makes it look so easy, bid, win, charge!!!!

We have 2 older model cars, paid cash, put a few “payments” worth set aside for any car emergencys. Saves a ton on money by no monthly car payments.

one of them is a ’97 ford,paid $700. put on a timing belt and have been driving it for 5 years. anyway I do the math its a good deal.

I agree the credit reporting industry is a self serving blackmailer.

jamie · May 21, 2010 at 3:24 am

I’m not saying a credit card is bad for most folks, just bad for me. It is to easy for me to spend beyond my means. So I do without, save or layaway items.

Do I miss the ease of credit card? Sure but the ease of it is what got me in debt. I like being out of debt better.

I suppose I could be nice and opt out via mail. But heck they send me this junk mail I don’t ask for it. So yeah I’ll hit them in the pocket book on mail costs.

I tried the nice method of writing or indicating I did not want the flyers or junk mail. It did not work, but a few envelopes full of the junk they send me, Sent back to them has really cut down on the credit card offers.

I tried nice now I’ll get a bit nasty, if I get another offer I’ll do the mail a brick back method.

Believer · May 21, 2010 at 5:53 am

Wow!That’s a lot of good information. I worked for a major line of national stores at one time. One time they showed us the info they had on people–not necessarily those with their Credit Card. The info they had included their house, cars children, dogs, and neighbors and the neighbors info. I couldn’t believe it. After they showed us this info, we were told that if we accessed it, we would be fired. (Go figure.)

There really is very little or no privacy anymore. The less information and power we give them the better.

terilyn · May 21, 2010 at 10:42 am

This is probably one of the best pieces you have ever written on your site. The wisdom you exhibit in it is astounding. I am not LDS (we are Charismatic), but honestly since learning more about the LDS lifestyle, I am very impressed with the wisdom you use in everyday life. You have organized ways to help the members of your faith and teach them to be frugal, prepared, honest, and faithful. The older women really do teach the younger women to be chaste discreet keepers at home. The church really does prepare the people to work faithfully and help each other in need, yet prepare to avoid need. It’s amazing how wisely organized you all are as a group of brethren. I don’t know if this particular teaching (save to buy, don’t borrow) is from the church, but it is wise. Nice piece on the topic.

What is the divorce in the LDS church? I am guessing it is lower than the rate in most Charismatic/Pentacostal churches because they almost mirror the fifty percent of the world.

terilyn · May 21, 2010 at 10:44 am

Sorry, I meant “divorce rate”. I left out a word. Typo. I am just guessing the rate within the LDS body would be much lower than some other parts of the Christian denominational world.

Kellene · May 21, 2010 at 5:37 pm

While the divorce rate is lower among the LDS faith than mainstream, it is still, in my opinion, very sad and shameful. Religions are made up of imperfect people who try to align themselves with perfect principles. Sometimes we do great and sometimes, not so great.

Bruce Gaylord · May 21, 2010 at 1:44 pm

Nice article. I still make car payments and I will until the day I die. I make payments to myself into my credit union account every paycheck. When my current vehicle is ready to retire I will pay cash for another. And it won’t be a new vehicle. Most people don’t realize or make the connection that a vehicle is usually their second largest asset, and this asset will only lose value from the time it is purchased. Buy 1-2 yr used vehicles with cash and let someone else take the 20-40% hit in value loss.

Again nice article.

Suggestion for future article-why we should end our primary banking relationship with the Banks and move our money to local Credit Unions or Savings Associations.

MichaelB · May 21, 2010 at 3:36 pm

The last line is a powerful phrase, “Live life, don’t leverage it!”

While I strongly agree with that statement, I have to say I have a hard time seperating my credit score from my life. It was a fun thing when we went to apply for our mortgage and the mortgage guy was bowing down to us after looking up mine and my wife’s scores. You’ve definitely given me some things to think about though in regards the relevance of this number in our lives.

quigath · May 21, 2010 at 6:51 pm

I still don’t understand how I’ll be more free if I give up my credit cards. I have excellent credit, I can pay for anything I can afford at anytime, and one of my cards gives a cash rebate. How will my giving up the ability to buy, improve my quality of life?

Please explain for someone in my situation.

Katie · May 24, 2010 at 5:51 pm

If you can pay for anything you can afford at any time, then why are you using credit cards? If you walk into the store with a big wad of cash, you’re a lot more likely to get a better deal that would more than pay you back for the cash rebate.

UncleJoe · May 22, 2010 at 10:26 am

Kellene,

I looked up Title 26 in regards to not giving your SS# to open a bank account. Title 26 is 1,000’s of pages. Since you have evidently done a lot of research to obtain this information, would you consider pointing us in the general direction as to the title, sub-title, chapter, sub-chapter, section, … well you get the idea.

Thank you for all you do here at preparednesspro.

Joe

Kellene · May 22, 2010 at 8:24 pm

Sorry Joe. No can do. If I do, I am advised that it would be akin to giving legal advice, which is why I point you to the title instead of a closer area.

UncleJoe · May 23, 2010 at 2:07 am

OK. Thanks.

BTW. If you can find a minute in your day, stop in at PS. You have a PM.

jamie · May 23, 2010 at 7:03 am

I got sick and became 100% disabled at 41 years old. I did not plan for it, I had a good credit rating before I got sick. Needless to say it took a real beating after not working and having a paycheck for 9 months. I was so lucky my parents were able to help me out and I kept my house. But it was truly terrifying. Thank God I had no family besides myself to worry about at that time. I’ve paid most of what I owe back to my parents and I am working on the last $5000.00 I owe to them.

I did take out a small 2 year loan for a mini-van because I needed it because of my handicap and also to build some credit back up. But every time I feel tempted on a credit card I read the fine print, or someone will talk of a jump in interest rates or fees. I no longer feel the need to get off cash or layaway as my main system of finance. Yes it is a bit harder not to get stuff right away. But I find peace of mind of mind in paying cash. If I buy something it’s mine, I own it and the only way I lose it is if someone steals it. I have insurance and I’m well armed. I like that better than a credit cards or repo men.

I think the debt-free living book and Kellene has made me a great money handler. Folks still don’t believe what I have accomplished by being mostly debt-free and shopping/prepping like Kellene. Heck I’m amazed at what I ‘ve accomplished. If you said 18 months ago I’d have 18 months of all groceries, 4+ months of water, a BOB and a plan, extra ovens and heating, buy 3 guns and ammo (Sorry K only up 250 rounds per weapon)working on that , a garden and bunnies. I’d have said you were insane, and heck I haven’t really started on couponing. It wasn’t easy but Kellene never gave up on me. All less than $18,000 a year and no GOV. assistance. Gosh I have an propane oven, a smoker grill and fuel for both for 6 months.

If you listen to Kellene you will get prepared. You will save money. You will have great food to feed your family. You will be prepared. I can’t ask for more than that.

Oh, I think I’m getting the cheese wax thing from theory to practice. I refrigerate the cheese after waxing. Just to firm up the wax. Yes you are right again on the coats. I use mesh laundry bags to hang the cheese. I get them at the dollar store.

Kellene, it’s working more folks are ready to prep. I am so excited to share knowledge and send them at you. This is so awesome.

Julie · May 23, 2010 at 11:52 pm

I appreciate the reminder to be debt free. A man in debt is a slave to interest and all that goes with it.

Thanks for the great posts!

Debbie · May 25, 2010 at 10:48 pm

I have one credit card that I use for every purchase that I can, and I pay it off in total every month. I even ( ten years ago ) put the down payment of my car on it. I get points on this card and with the points, I get free groceries. I have a checking account with the same company and a saving account. They don’t even have a fee for these accounts. (this is a financial institution in Canada). We have only gone in debt to buy our house and cars. They were modest and we could afford them. We are now debt free, except for house taxes, and monthly water, hydro, gas. A good thing, as my hubby now has a debilitating disease and can no longer work. I look after him, and we live off our savings.

Jamie · May 25, 2010 at 11:04 pm

@ quigath There is nothing wrong with having great credit. The question is are you a slave to your debt? Are you capable/willing to walk away. I’m not saying don’t pay your debt but is the Flat screen TV worth the cost? Granite counter tops are nice, but if you are keeping your home are you really looking to drive up the value of your home for taxes?

Can you eat for the next 18 months, 2 harvests, cause I can and have fresh greens throughout. Do you have fresh, safe, drinkable water for 3-6 months. I do. I don’t have a great credit rating. But do I have food,water, shelter and security.

It’s kind of like explaining having a Harley. If I have to explain you won’t understand. If you understand I don’t have to explain.

@ quigath all we are doing are giving you options/info for where you want to be and how to get there it’s your choice. What you do is up to you.

Jamie · May 28, 2010 at 2:10 am

Deb you are doing great. Don’t let other folks steer you into debt. It’s so awesome to hear folks that break free of that debt meery go round. I know Kellene doesn’t count debt high On her prep and I understand as well. But getting debt-free is a party moment.

It’s funny I have had several folks recommend debt to get ahead. WOW that doesn’t seem right to me. Well I guess I’ll keep building on food,cooking,fuel and the basics. IF I’m wrong I still have food, fuel, security, warmth, cooking and the basics. If I’m right they will hold paper. I can live with that.

jamie · May 28, 2010 at 5:48 am

@q I recommend you get debt free. Kellene has never done that beside live within your means. My own background recomends it. But it is your life and if you prep you will be ahead of the game no matter what happens. We aren’t here to judge just give you ideas and how they can work for you and how they have worked for us in the forums.

Do I beleive SHTF, yes I think it will happen. I may be wrong. Gosh knows I’ve been wrong many times before. But even if I am wrong I have food and stuff for a natural disaster. Or I have saved money and can eat off my pantry for several months. So I see my planning as a win/win. I’ve lost no value actually gained in value in sugar.

Most investments have risk component. All we suggest is you invest in a sure thing (Food) you will need it in the future. But it is your choice and no one here can force you to invest. You may not like our investments but besides you thinking we are idiots how does it affect you?

theotherryan · June 5, 2010 at 2:21 pm

I think the primary issues are:

A) If you are an adult who can make mature decisions with a credit card. Some people just can’t.

B) If you want to have one.

I’ve got a credit card. It is linked to my primary bank so it is pretty convenient. I like using it for plane tickets and stuff where we have the money but aren’t exactly sure of the amount. I can use it and then transfer the money around afterwords from wherever we saved for that goal. I did a bad thing a couple months ago and forgot to pay it on time, we paid .69 cents in interest.

We don’t do car loans or consumer loans or whatever. If we can’t afford to pay cash (check/ debit/ whatever, just not credit) for it we save up until we can or don’t get it.

Our credit score is solidly good. We don’t really war game it or anything. Just save, spend reasonably and don’t carry debt.

Comments are closed.